Protesting Property Taxes

It's that time again! Property values are being assessed by your local county! Let's talk about how to get those values down:

Types of Value

Let's start by establishing a few key terms in this discussion:

Market Value: The amount a ready, willing, and able buyer will spend to purchase your home on the open market in an "arm's length transaction".

Tax-assessed or "appraised" value: The value attributed to your home by your local appraisal district for taxing purposes. A lot of people associate this with the market value, but they are very often very different.

Net appraised value: This is the tax-assessed value, minus any exemptions you may have, such as homestead, senior or disability.

Your taxes are based on your local tax rate x the net appraised value. So if your tax rate is 2.2% and your home's tax-assessed value is $400k minus a $5000 disability tax exemption (net appraised value of $395k), for example, $395k x .022 = you owe $8690 in taxes.

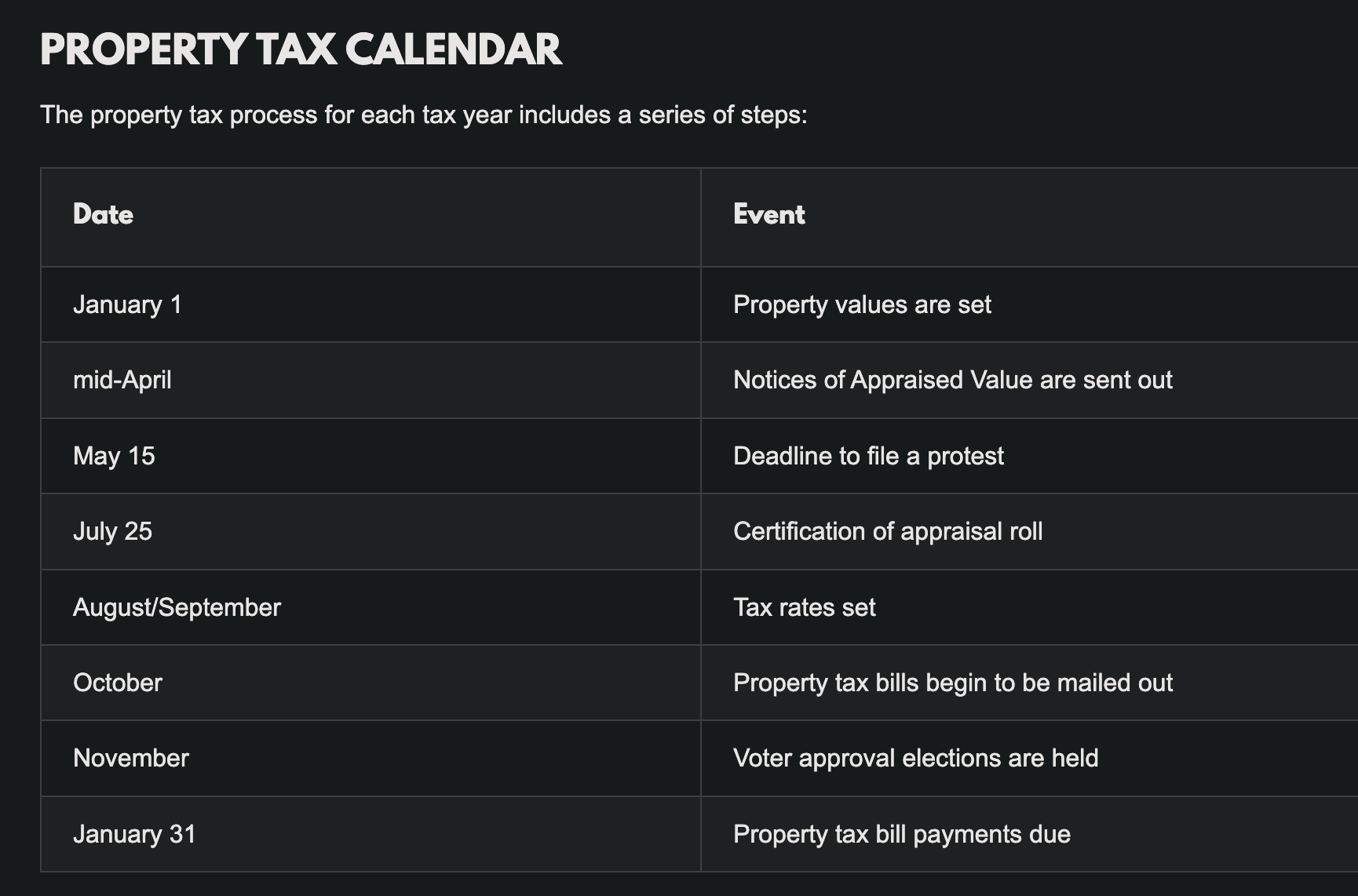

Property Tax Calendar

May 15th is the last day to file a protest in Travis county. See the full calendar below:

Property taxes in Texas are paid "in arrears" or, in other words, at the end of the year. When you pay taxes in 2025, they are based on your home's tax-assessed value in January of 2024. For that reason, most mortgage banks will "escrow" your taxes into your mortgage on a monthly basis, to ensure you don't have to pay a large lump sum at the end of the year.

If you purchased a home in the same year, you should have received a credit from the seller for the taxable amount from Jan. 1st until the day of closing. Of course, this is an estimate because they often do not yet have the proper information to give an exact value. There's a good possibility that someone owes someone else a bit of cash. If the seller owes you a difference, contact your title company about recovering it.

How to file a tax protest

Self file

You can choose to file a tax protest yourself with the county, using the link below (for Travis):

https://travis.prodigycad.com/public-portal/sign-in

This is a very time-consuming process and, in my opinion, not worth it.

Outsource the work

The way I do mine, and what most other real estate professionals I know do, is to let a tax protest company handle it for you. It takes about 5 minutes to set up, and its a very hands-off process. They handle everything, and they automatically renew every year unless you opt out. It's a very "set it and forget it" process. Most often they will charge a small flat fee + a percentage of the amount they saved you in taxes. In some cases they don't even charge you the flat fee.

Personally I use and recommend HomeTaxShield:

https://hometaxshield.com/partners/brooks-lawson

Please note the above is a referral link, however, as always, I do not collect any referral fees (except when referring to other agents outside my service area). HomeTaxShield will give me a credit which they then donate to a non-profit on my behalf. It also gives me a little bit of insight, as I can see the success rates of each property that signs up with me.

Some other popular options are listed below:

There's also SquareDeal, which falls somewhere in the middle. They just send you a packet of relevant information for use in your self-filed tax protest for $69 (nice!)

Should I protest my taxes every year?

According to the professionals, yes. Personally, I don't understand why exactly, but it seems like maybe the county applies a % increase to existing property values as values in the area go up, so protesting every year will keep your current value as low as possible, thus lowering the next year's.

Encourage your neighbors to protest their property taxes

If the property values around you are lower, yours will be lower as well, as they're comparing your property to other similar properties in your immediate area for value.

Have questions? Contact me using the information listed at brookslawson.com