How much should I use as a down payment on my home?

Federal incentives have helped, yet still the down payment remains one of the biggest hurdles to potential new homeowners.

Federal incentives have helped, yet still the down payment remains one of the biggest barriers to potential new homeowners. Someone once told me at a fairly young age (during the subprime mortgage global financial crisis) never to buy a house unless you used a 20% down payment. This was someone I respected, and as such I also respected their advice, but as I entered the real estate industry some years later I began to realize just how badly that advice had negatively impacted me, financially. And for a long time, I bought nothing because I didn't have the cash and all the while home prices had risen precipitously around the world, and trying to save up 20% just became harder and harder, and if I had just gone ahead and bought I would have been building equity while my property continued to appreciate, and I would have reached that 20% equity in no time. I did not get into home ownership until many years later.

Granted, the same strategy at a different time obviously did not work out for him, but that was the exception, rather than the rule, and if he had held onto that home for just a few more years (which he definitely could have) he would have been much better off.

The simplest advice I can offer is to buy as soon as you can. Hopefully (for you) the market continues to appreciate as it has historically.

Home ownership is one of the greatest indicators of long-term wealth and stability.

What is the minimum down payment required?

It depends. Typically a conventional loan can be as low as 3%. An FHA loan as low as 3.5%. And USDA and VA loans can be had with no down payment at all.

Private mortgage insurance

The main reason people tell you to put down 20% is to opt out of an additional fee called private mortgage insurance (PMI). This is insurance your lender will require you to buy in the case that you default on your loan, in order to recoup the losses when they have to repossess and resell the home.

But don't get it twisted, paying PMI is very much worth it to cross the barrier into home ownership. After you eclipse 20% equity, you can notify your lender and have the policy removed from your mortgage. If you're counting your new home value in that 20%, you'll have to get an appraisal that reflects as much.

The lender will not remove this on their own! You have to reach out and notify them to begin the process.

During the pandemic we saw buyers getting out from under PMI in only a few months, due to large and sudden increases in their property value.

Is there down payment assistance?

Yes! Down payment programs exist that help disadvantaged homeowners, but they do come with a cost so don't use them if you don't need them. Click the link below and answer a few quick questions to find out if you qualify:

How much should I use as a down payment?

My recommendation would be to put the absolute minimum down payment you can get away with, and invest the remainder of your free cash into something that will yield a higher return on investment (ROI) than your mortgage will cost you.

Let's compare 2 scenarios

Let's say, hypothetically you are purchasing a $500k (to keep the math simple) home. And you choose to put down 30% instead of 20% (just to avoid calculating PMI). 10% of $500k is $50k, so that is the additional funds you're putting down.

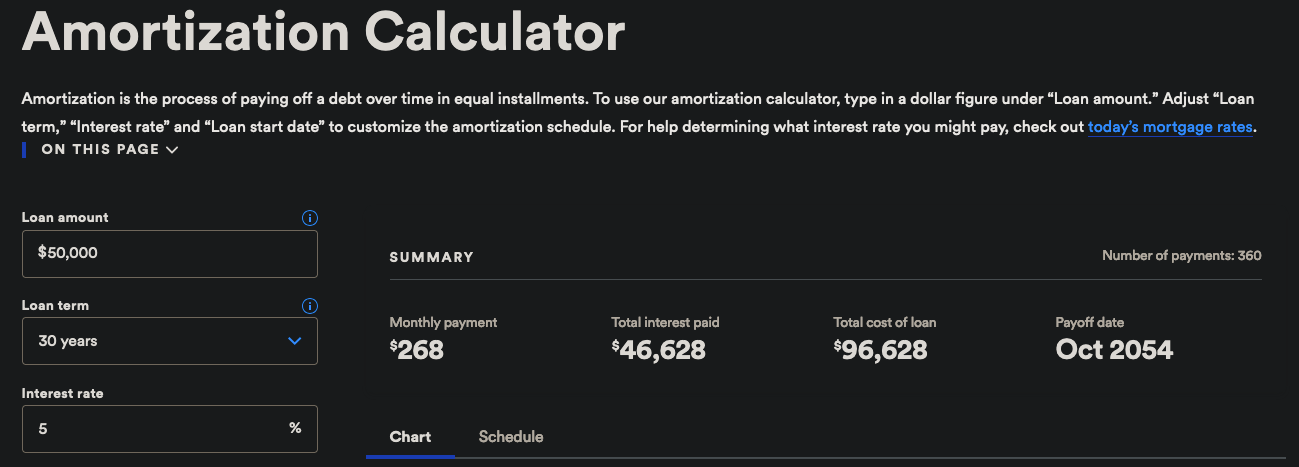

Now the math on this is complicated due to mortgage amortization so I'm going to loop in my friend the amortization calculator:

By putting an extra 10% down you will have saved yourself $46,628 over the course of the loan/mortgage (assuming you don't move again for the next 30 years). Wow! How great is that!?

Now let's explore the potential opportunity cost (the cost of not doing something else with that money) of that decision. If you took that same $50k and instead invested it into an S&P500 index fund 30 years ago, you would have realized a ~1200% gain or $550,000. (Sorry, I couldn't find a good visual for this).

That's a ~$500k (~1100%) advantage over putting extra on your down payment!

Now imagine you bought that same home 100% in cash: That's $5.5M you lost in opportunity costs!

Will that happen again over the next 30 years? Who knows, but ETFs historically have an excellent track record, long term. So probably. Also there are any number of different ways you can invest that money that will likely exceed the 5%, or whatever your mortgage interest rate ends up being.

Should I get a 15-year mortgage?

Again I'll refer you back to the previous section.

This is just my personal opinion. You need to make decisions based on your own aversion to risk.