Date The Rate, Marry The House

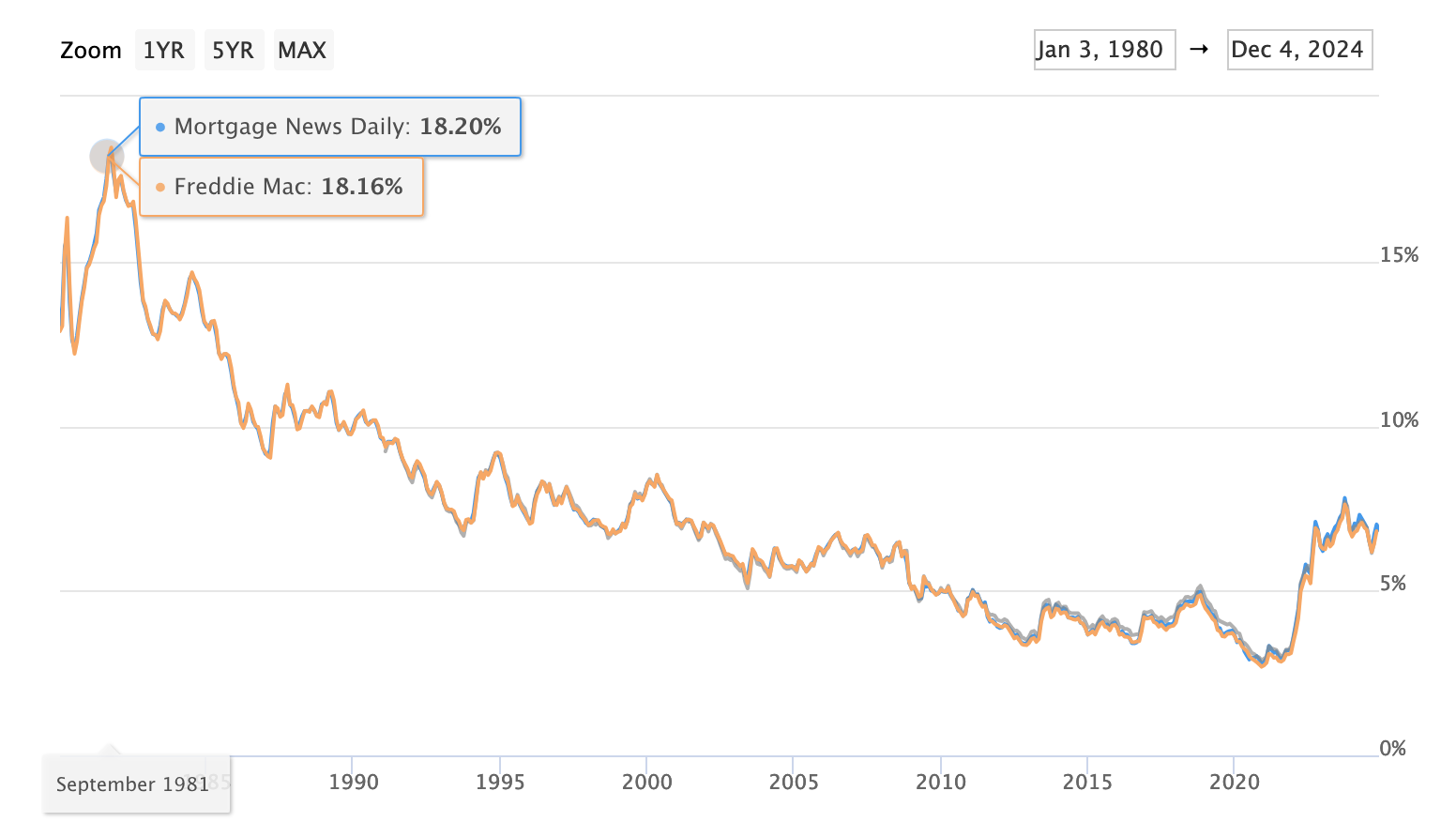

You probably don't need me to tell you this, but right now, interest rates are higher than they have been in recent history, and in particular, higher than they were over the last 10 years or so. What a lot of people may not tell you is that we were in a sort of "bull run" for those 10 years. A lot of us had it good, and we didn't even know it. Boom! Welcome to 2024!

Many of my competitors will assure you that interest rates historically have been much higher. And indeed it is true. In the 80's interest rates reached as high as 18%!

What they'll conveniently neglect to mention is that housing prices in that time were in the 5-digit range, so even with the higher interest rates they were still relatively affordable.

You might be saying to yourself "Well I'm going to wait until interest rates come back down", which is a reasonable position. If you're a current homeowner, and you don't absolutely need to move, by all means you should not. You'll likely save some money on the price of your new home, at the expense of your old one, and your new interest rate will double. The only one who wins in this situation is the banks.

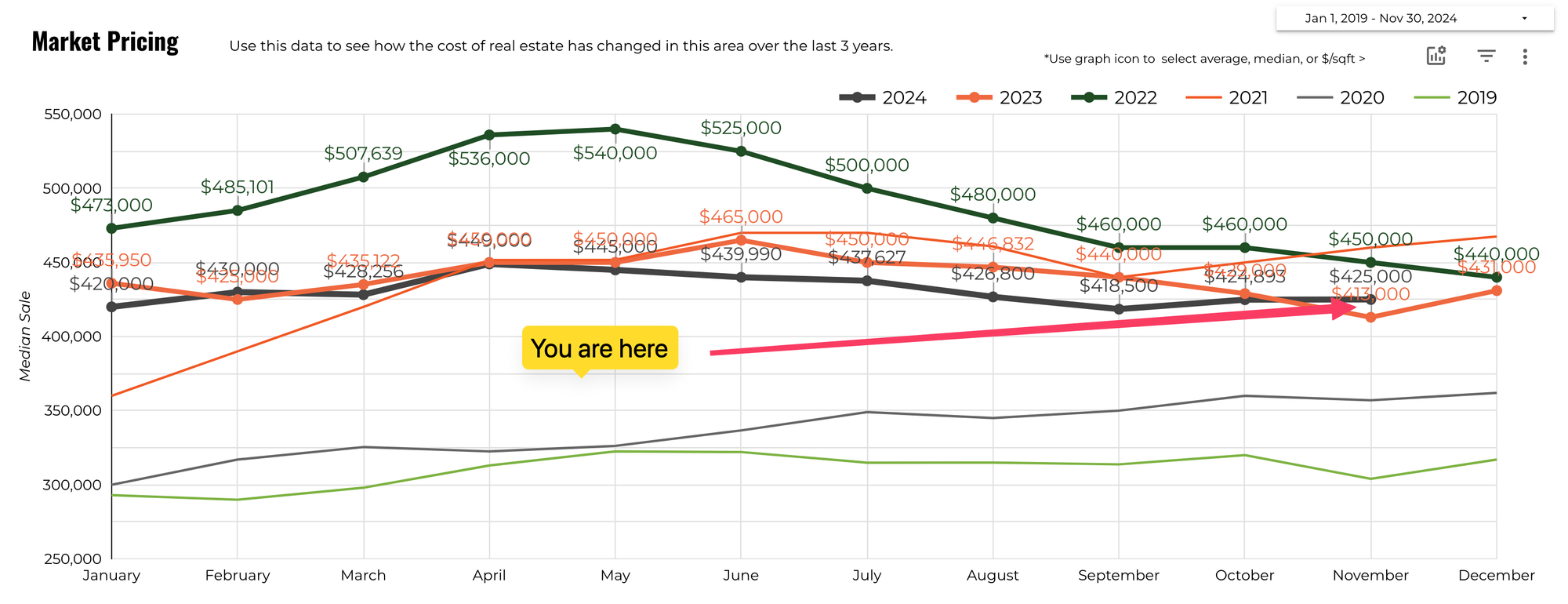

However, if you're a renter sitting on the sidelines, I'd ask you to consider the future. Right now, as of writing, home prices are actually relatively low.

Now ask yourself why they are low; the answer is interest rates. Most homebuyers will purchase as much home as they can reasonably afford, which makes sense considering (for better or worse) homes tend to appreciate over time, so if they stay in their home long term (generally 5-7 years) they're likely to get their money back. Markets ebb and flow but pre-covid (2020) home prices were closer to ~$350k and as a trend they have increased for the last...forever. So, if homebuyers can afford more, they (generally) tend to spend more. Naturally, a high interest rate will eat into how much home they can reasonably afford to purchase, and thus they're willing to spend less, and values go down.

This is where "date the rate; marry the house" comes in:

Current interest rates are likely unsustainable long term, and will likely have to come back down at some point in the (hopefully near) future. As much as I wish I could tell you when (if I could I'd be very wealthy), I can't.

So what happens when rates come down? Well, naturally, the inverse of what happens when they go up; prices go up, which means the value of your home goes up. Meanwhile you can refinance your current mortgage at a lower rate. At which point, you've had your cake and eaten it too; You've secured your home at the lowest price while your home value increases and your mortgage interest rate decreases.